Hugh Grant

http://reneweconomy.com.au

12 May 2017

After two days of debate on the Federal Government’s proposed big bank levy, it appears that Scott Morrison’s only justification for the levy is that Australia’s banks are profitable and unpopular.

Lazy policy indeed.

I don’t usually feel sorry for the banks, but on the basis of Scott Morrison’s profitability and unpopularity criteria, there is a much more obvious target sector for such a levy.

Few people would understand this more than Anna Bligh – ex-Queensland Premier and Treasurer; now CEO of the Australian Bankers Association.

As Bligh is well aware, Australia’s monopoly electricity networks are the most profitable businesses in Australia – by far.

Over a year ago, I performed an analysis of the actual returns that the Queensland government realised from its investment in two electricity networks (Powerlink Queensland and Energex) over the previous 15 years; and compared those returns with the returns that it would have realised if it had invested the same dollars in blue-chip ASX 50 companies in other sectors of the economy.

That analysis confirmed what the networks and their owners have known for many years – that Australia’s monopoly electricity networks are achieving many multiples of the returns of any other sector of the Australian economy.

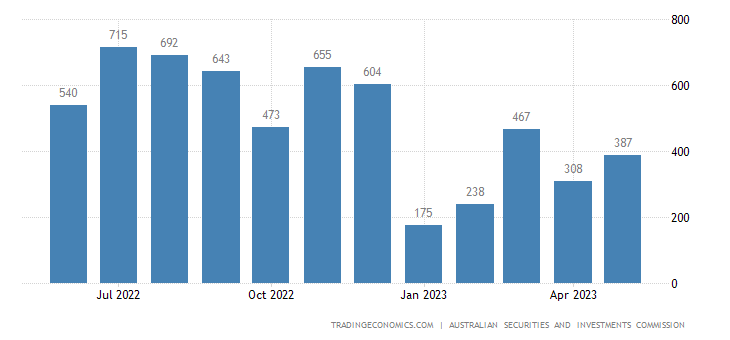

For example, as illustrated in the chart below, over the past 15 years, the Queensland government’s equity investment in Powerlink Queensland accrued returns of:

- 23 times the returns achieved by the Australian construction sector (Lend Lease)

- 15.5 times the returns achieved by the Australian telecommunications sector (Telstra)

- 10.5 times the returns achieved by the Australian minerals and resources sector (BHP)

- 10 times the returns achieved by the Australian banking sector (NAB)

- 3.6 times the returns achieved by Australia’s most profitable supermarket (Woolworths)

With Australia’s electricity networks achieving such extraordinary returns, it is not surprising that investors are queuing up to purchase them when they come up for sale, paying well in excess of the networks’ regulatory valuations.

This week’s announcement of the NSW Government’s sale of Endeavour Energy at a multiple of 160% of the network’s regulatory valuation (which followed the recent 165% multiple achieved from the sale of the NSW transmission network (TransGrid)) is yet another confirmation that investors expect to continue to realise extraordinary profits at consumers’ expense, by exploiting Australia’s deeply flawed network regulatory framework.

Thanks to ozi@oztruthseeker for this Article – Mick Raven

LikeLike